MLM businesses are growing rapidly. According to the Direct Selling Association, approximately 14.6 million people participated in MLM businesses as of 2022. That’s 8% of the total population.

Therefore, the MLM businesses affect a huge number of people, and the Federal Trade Commission’s duty lies in safeguarding them. When MLM businesses knowingly or unknowingly function as pyramid schemes, it leads to scrutiny, penalties, and loss of trust.

To operate smoothly and maintain a reputable standing in the MLM industry, businesses must be familiar with MLM rules and regulations.

For coming up with this article, we have checked all the laws and regulations governing MLM compliance and brought you a complete overview.

In the end, you’ll be well aware of MLM regulations and their compliance requirements.

This Article Contains:

What are the MLM Laws, Rules, and Regulations?

In the simplest possible terms, MLM laws, rules and regulations refer to the legal guidelines set by the Federal Trade Commission (FTC) and other organizations that monitor the functioning of MLM companies to ensure that they don’t operate as pyramid or Ponzi schemes, market their products truthfully, communicate with distributors transparently, and maintain proper documentation as required.

Now, let us provide a few examples where direct selling compliance fails when businesses knowingly or unknowingly break the network marketing rules and regulations.

There’s a skincare company falsely claiming that its products can remove acne in seven days. However, this claim was rejected by many consumers, who filed complaints against the company for its fraudulent act. As a result, an investigation was initiated, and the company’s license was suspended.

Now, this could be true of any company that is operating in the same industry, be it MLM or not.

So, let’s provide you with instances that are directly linked with MLM compliance:

A distributor purchased the inventory, but wasn’t able to sell it. He puts in a return request, which the MLM company rejects. As the distributor lost money, it can put the business under scrutiny under the Federal Trade Commission’s guidelines.

A distributor made sales by himself but wasn’t interested in recruiting new distributors and training them. The MLM company rejected the payout as the distributor had not built a downline. It’s illegal to force a distributor to build a downline, and the company came under scrutiny.

These are some basic examples, and as we dig deeper, you’ll understand how even a minor misstep can lead to a major compliance issue.

Multi Level Marketing Laws and Regulations in the United States

There is no one specific multi level marketing law according to which MLM businesses can ensure compliance. Rather, there are multiple relevant acts from which one needs to grab what’s directed to MLM compliance.

That’s one of the reasons why MLM compliance appears complicated, and businesses fall into the pyramid pit without even knowing about it.

To explain to you about the MLM regulations landscape in the USA, we have gone through each of the relevant acts and picked what’s useful.

Section 5 of the Federal Trade Commission Act (FTC Act)—An Essential MLM Act

In the Statement of Enforcement Principles Regarding “Unfair Methods of Competition” Under Section 5 of the FTC Act, it is mentioned that:

“Congress chose not to define the specific acts and practices that constitute unfair methods of competition in violation of Section 5, recognizing that application of the statute would need to evolve with changing markets and business practices. Instead, it left the development of Section 5 to the Federal Trade Commission as an expert administrative body, which would apply the statute on a flexible case-by-case basis, subject to judicial review.”

Therefore, there’s no direct mention of MLM practices under section 5 of the Federal Trade Commission Act (FTC Act). Still, it is considered the governing act for the MLM business.

The key to MLM compliance lies in ensuring that the MLM business doesn’t fall under “Unfair methods of competition in or affecting commerce and unfair or deceptive acts or practices in or affecting commerce.”

Because there are no direct guidelines in the FTC Act, MLM businesses struggle to identify the exact compliance requirements.

However, the FTC released a separate resource for “Business Guidance Concerning Multi-Level Marketing” to support MLM businesses in aligning their practices with core consumer protection principles. The resource covers:

When an MLM falls under the definition of an illegal pyramid scheme and how to maintain compliance to ensure it does not.

Guidance regarding representations about income and earnings claims to current and prospective participants.

Agent Liability for making claims and overall compliance

In this section, we’ll discuss the Federal Trade Commission’s recommendations to ensure your MLM business stays compliant. However, one must note that these are recommendations and do not represent the views of the commission and are not legally binding.

| Aspect | Compliance Requirement |

|---|---|

| Compensation Plan |

Note: Here, “large” and “regular” can be subjective. Therefore, you need to take stringent action if you track repeated purchases without sales. Also, your compensation plan must be designed in such a way that it puts a cap on how much a person can keep in their inventory. |

| Training |

|

| Earning and Expenditure Claims |

|

| Marketing |

|

| Agent Liability |

|

| Purchases |

|

| Buyback/ Refund |

|

| Record Keeping |

|

| Product Claims Advertisement |

|

FTC Business Opportunity Rule, MLM Law

Under the FTC’s business opportunity rules, the business opportunity seller must provide prospective buyers with all necessary information regarding the business opportunity. The information should be disclosed in the disclosure document given to the prospective participant. This is to enable prospective participants to evaluate a business opportunity, its benefits, and associated risks.

Most MLM businesses don’t fall in this category. This rule is applied only when the business arrangement meets the legal definition of a “business opportunity.” However, it’s recommended to follow the practices mentioned under the business opportunity rule because it helps build trust and supports overall compliance.

In the context of network marketing, the business opportunity seller can be considered the MLM business, and the buyer of the business opportunity can be considered the distributor.

The business opportunity rule allows a commercial arrangement where the seller or MLM business solicits a prospective buyer in exchange for initial products, which are refundable in case the distributor decides not to continue. Misrepresenting an MLM opportunity as an employment opportunity is illegal as per multi-level marketing laws. Besides that, the material assistance that MLM businesses plan to provide distributors should be clearly mentioned and followed.

Now, let’s discuss what information needs to be disclosed before making the commercial arrangement.

Identifying Information

The MLM business must provide the distributor with the general information about the company:

Registered name of the company

Business address

Telephone number

Member details who recruited the distributor

The date when the disclosure document is presented to the person

Earning Claims

It is recommended to share the earnings and provide the prospect with an honest picture to stay compliant with multi level marketing laws under Section 5 of the Federal Trade Commission Act (FTC Act).

There are certain points that you must take into consideration while making the earning claims:

Must be supported by reasonable evidence when asserted.

Maintain the written documents supporting the earning claims.

The start and end dates for which the claimed earning is made.

The number of people who became distributors for whom the claimed earning is calculated.

Present the average earnings, the earnings of the top 10% of distributors, and the earnings of the top 1% of distributors.

If you are located in multiple countries, claim details must be provided for all countries separately. It’ll even be better if you can provide state/province-specific earning claims.

The earnings claim should be available in the general media as well as provided to the prospect before recruiting.

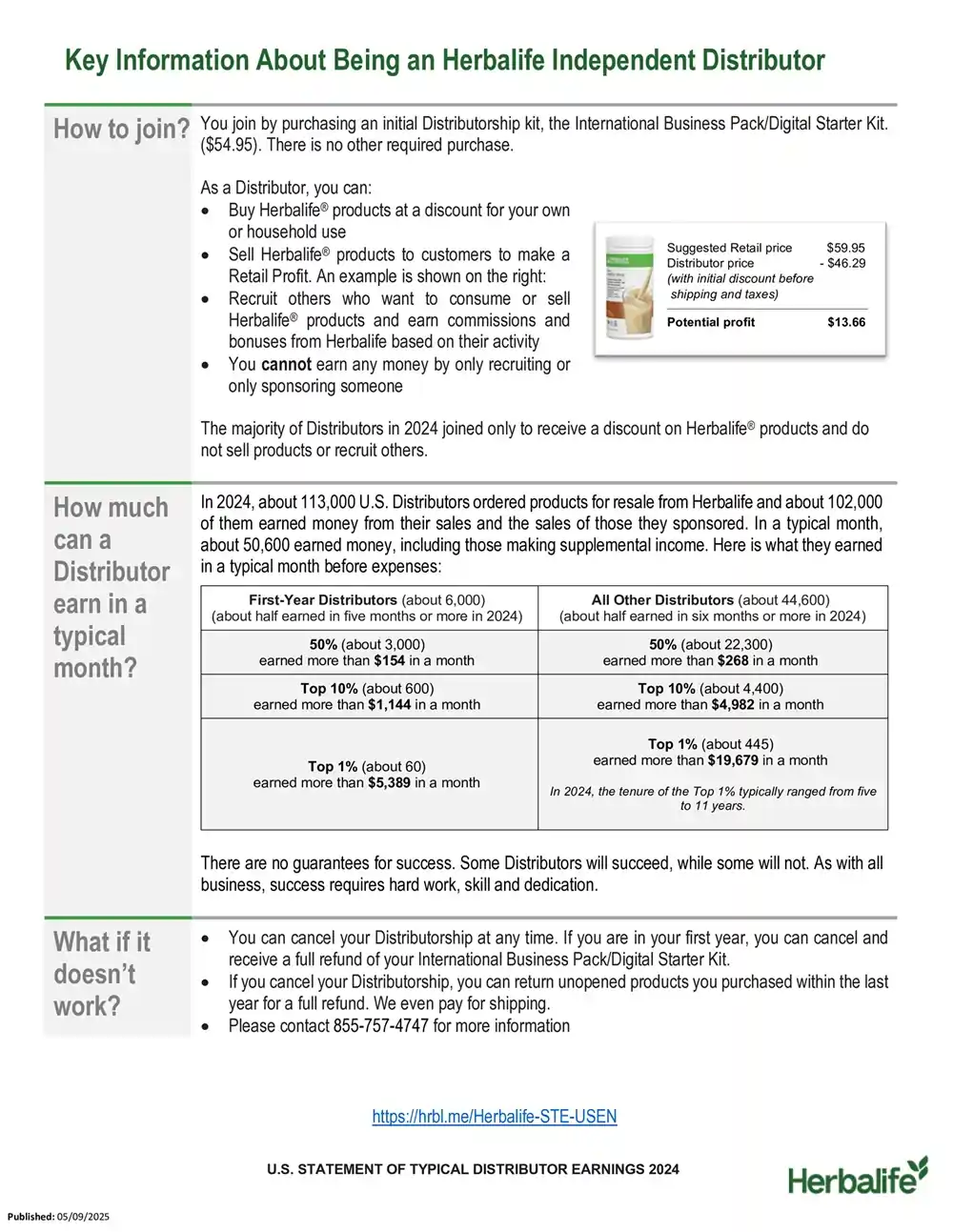

Let’s take Herbalife’s example of how it presents the earnings claim:

Source: Herbalife

It provides the following information:

The year for which the earning is claimed; it must be updated every year

How distributors made the earnings

Number of distributors who ordered products for resale and how many of them earned money from sales.

Earnings for the distributors for their first year and overall earnings for all distributors, categorized under top 50%, top 10%, and top 1%.

The statement “There are no guarantees for success…. “makes a difference. It ensures that no one questions the MLM business of following unfair or deceptive acts. However, working hard and skills can be subjective, and there’s no way to measure them. Therefore, you need to define the number of hours and level of skills the distributor needs and share this information before the prospect joins the business.

It’s recommended that distributors be informed of a specific range of actual or potential sales, or gross or net income or profits. For new MLM companies, it can be based on market research and competitor performance. However, companies already working with distributors must show the income generated through them.

MLM businesses must provide the prospect with the predictive analysis for the earnings based upon the available data, earnings of the past, existing distributors, and probability.

Tip: Earning claims should be complemented with the efforts required to generate the income, and details on how the MLM business supports the distributor if it doesn’t work out.

Information Regarding the Criminal History

If the member who recruited the distributor, the MLM business founder, or any of the people in management authority such as officers, sales managers, directors, or people who perform similar functions as management authority are subject to any civil or criminal action for misrepresentation, fraud, securities law violations, or unfair or deceptive practices, including violations of any FTC Rule, within the 10 years immediately preceding the date that the business opportunity is offered, then the MLM business needs to disclose this information publicly.

The business should give individual details for every legal action:

Name of the principal parties

Case number

Full name of the court

Filing date

Brief, accurate statement describing the legal action (100 words max)

Cancellation or Refund Policy

MLM business needs to mention that it provides the distributor with the right to ask for a refund or cancellation of the purchase.

MLM compliance best practices include a buyback policy as well.

Let’s take Herbalife’s example here:

Herbalife allows the distributor to return all the products within 30 days of purchase for a full refund.

After 30 days, the distributors are still eligible for a refund, but no bonuses are provided, and a 10% service charge is levied.

The products must be in good condition, unopened, and must have a sufficient shelf life of at least four months.

Distributors are also required to offer a 30-day money-back guarantee to their customers.

Shipping costs are not covered by Herbalife.

What’s important from the MLM business’s perspective is that they state each and every term clearly and accurately. For instance, Herbalife openly mentioned that it’s a 30-day purchase, and “it doesn’t provide a refund on shipping costs.”

Such clarity is required to stay compliant.

Misrepresenting any term or condition of the seller's refund or cancellation policies leads to non-compliance.

Distributor References and Prospect Privacy

MLM businesses should provide true and not misrepresented references of distributors who purchased the same business opportunity within the last three years. If the number of purchasers within the last three years is more than 10, then you can limit the references to 10 purchasers who are located nearest to the prospective purchaser's location and provide the information as mentioned in the previous point.

Provide the prospect with the name, state, and telephone number of all the purchasers.

The prospect’s approval should be obtained to allow the company to share their details with future prospects. Otherwise, it goes against the privacy laws if you share the details without approval.

Territorial and Geographical Details

A network marketing business must provide accurate details if the distributor is provided with a designated geographic area. The person must know where they can sell and where they can’t.

Also, if the MLM business claims to provide an exclusive territory to a distributor, they must not locate additional purchasers or offer the same or similar goods or services as the purchaser through an alternative channel of distribution.

Straightforward Compensation Plan

As per the business opportunity rule, any misrepresentation in the compensation plan is against multi level marketing laws. To guide what needs to be added and how it should be added, there are prohibited practices mentioned, where the seller represents the MLM business and the purchaser represents the distributor.

There must be a well-documented compensation plan available to prospects even before they join.

There must not be a misrepresentation of how or when commissions, bonuses, incentives, premiums, or other payments from the seller to the purchaser will be calculated or distributed.

There must not be misrepresentation of the cost, or the performance, efficacy, nature, or central characteristics of the business opportunity or the goods or services offered to a prospective purchaser.

Record Retention

Record retention has always been an important aspect for compliance with multi level marketing laws. It not only offers the audit trail to the FTC but also helps businesses to stay compliant. So, here is the list of records that MLM businesses need to prepare and retain:

Earnings claim statement and its proof

Disclosure document

A contract between the MLM business and the distributor, mentioning all the information required by the law

straightforward compensation plan

Other Rules and Regulations that are Applicable to the MLM Business

CAN-SPAM Act

Though the name is CAN-SPAM Act, it simply means you can’t spam. If your MLM business or its distributors use email or any electronic mail message to primarily advertise or promote your products or services, the CAN-SPAM Act is applicable as one of the multi-level marketing laws. It applies to both bulk messaging and one-on-one messaging.

Here are the CAN-SPAM Act guidelines that you need to follow while sending emails to prospects and customers:

A false or misleading header is prohibited.

The subject line must not be deceptive.

Your message must clearly show that it’s an advertisement.

It’s essential to disclose the complete physical postal address to the recipients.

There must be a clear explanation of how recipients can opt out of getting any more marketing emails.

When a person opts out, fulfill the request within 10 business days.

Monitor your distributors and ensure that they follow the same practices.

The Federal Trade Commission shared detailed questions and answers on the CAN-SPAM Act.

Restore Online Shoppers’ Confidence Act

Restore Online Shoppers’ Confidence applies to all the sellers that sell their products and services online, whether it's an MLM business, their distributors, or other e-commerce businesses. We’ll discuss what the Restore Online Shoppers’ Confidence Act requires MLM businesses and distributors to follow to ensure compliance:

They must provide the prospects and potential customers, or participants, with clear, accurate information online.

They must give other sellers an opportunity to fairly compete for consumers’ business.

MLM businesses and its distributors must protect the customer data and must not engage in the process of “data pass” and share customers’ billing information, including but not limited to payment details, with any third-parties, as these third-parties can mislead customers into paying for membership clubs with misleading information and aggressive sales tactics.

-

Charging through the negative option feature (as defined in the Federal Trade Commission’s Telemarketing Sales Rule) will be considered unlawful, unless the MLM business and its distributor:

Provides clear and easy-to-understand information regarding all material terms of the transaction before obtaining the consumer's billing information.

Obtains the consumer’s informed consent before charging through any of the payment methods to provide the products or services.

Ensure simple mechanisms for consumers to stop recurring charges.

Any violation of the Restore Online Shoppers' Confidence Act will be considered a violation of a rule under section 5 of the Federal Trade Commission Act regarding unfair or deceptive acts or practices.

The Consumer Review Fairness Act

The Consumer Review Fairness Act (CRFA) is to safeguard people’s right to share their honest opinion regarding the products, services, or conduct of a company, including MLM businesses.

To comply with this regulation, MLM businesses:

Must not establish contracts with distributors and end users that prohibit them from putting out their honest review, including but not limited to reviews on online portals and social media websites. These reviews can be uploaded as text, photos, videos, and any other media type. It not only harms the prospects but also the other businesses that are gaining positive reviews through sheer hard work and effort.

Must not impose a penalty fee or threaten legal action on someone who gives a review.

Must not require people to give up their intellectual property rights in the content of their reviews.

However, there are some exceptions to these MLM regulations where the reviews can be removed and prohibited:

When it contains private or confidential information.

When it is considered inappropriate and illegal to make a certain statement.

When it is unrelated to the company’s products and services.

When it is misleading or false.

Compliance Starts Now!

Several multi level marketing laws govern MLM compliance. However, from the MLM perspective, Section 5 of the Federal Trade Commission Act and the Business Opportunity Rule are the most important ones.

You still need to comply with other laws as well, which we mentioned in the article.

After going through all the relevant laws and regulations, we identify that the best way to stay compliant is to be true to your distributors and end customers. And you must inform, train, and monitor your distributors to follow the same.

If your MLM business follows ethical practices and keeps proof of it, compliance will be achieved.

Frequently Asked Questions

1. What is the MLM Act?

In the USA, there’s no specific “MLM Act,” but MLM companies must comply with consumer protection laws and Federal Trade Commission (FTC) guidelines. These regulations ensure companies don’t operate illegal pyramid schemes, require truthful income claims, fair marketing practices, and protect distributors and consumers from misleading or deceptive business models.

2. What laws regulate MLMs in the USA?

MLMs are regulated by:

Section 5 of the Federal Trade Commission (FTC) Act

The FTC Business Opportunity Rule applies when MLM participation is presented as a business opportunity

CAN-SPAM Act for marketing

The Consumer Review Fairness Act for review

3. Does the FTC require MLMs to disclose earnings?

Yes, as per MLM rules and regulations, if an MLM or its distributors make income claims, they must have a reasonable basis for the claim, provide written evidence if requested, and disclose what the typical participant earns, so recruits are not misled.

4. Do MLMs have to offer refunds or buyback policies?

Yes, it is essential for compliance to offer a refund or buyback policy. It includes:

Buying back unsold inventory from distributors who quit

Refunding at least 90% of the original cost.

Disclosing this refund policy clearly in their contracts

References

-

ftc.gov

-

ecfr.gov

Disclaimer: Global MLM Software does not endorse any companies or products mentioned in this article. The content is derived from publicly available resources and does not favor any specific organizations, individuals or products.