Costs to launch a U.S. direct-selling company vary widely, and not just because of filing fees. Your total cost depends on:

Where you operate

How many states have you registered in

Which licenses and permits apply

Whether your products require third-party testing or certification

How much legal and compliance work do you handle in-house versus hiring experts?

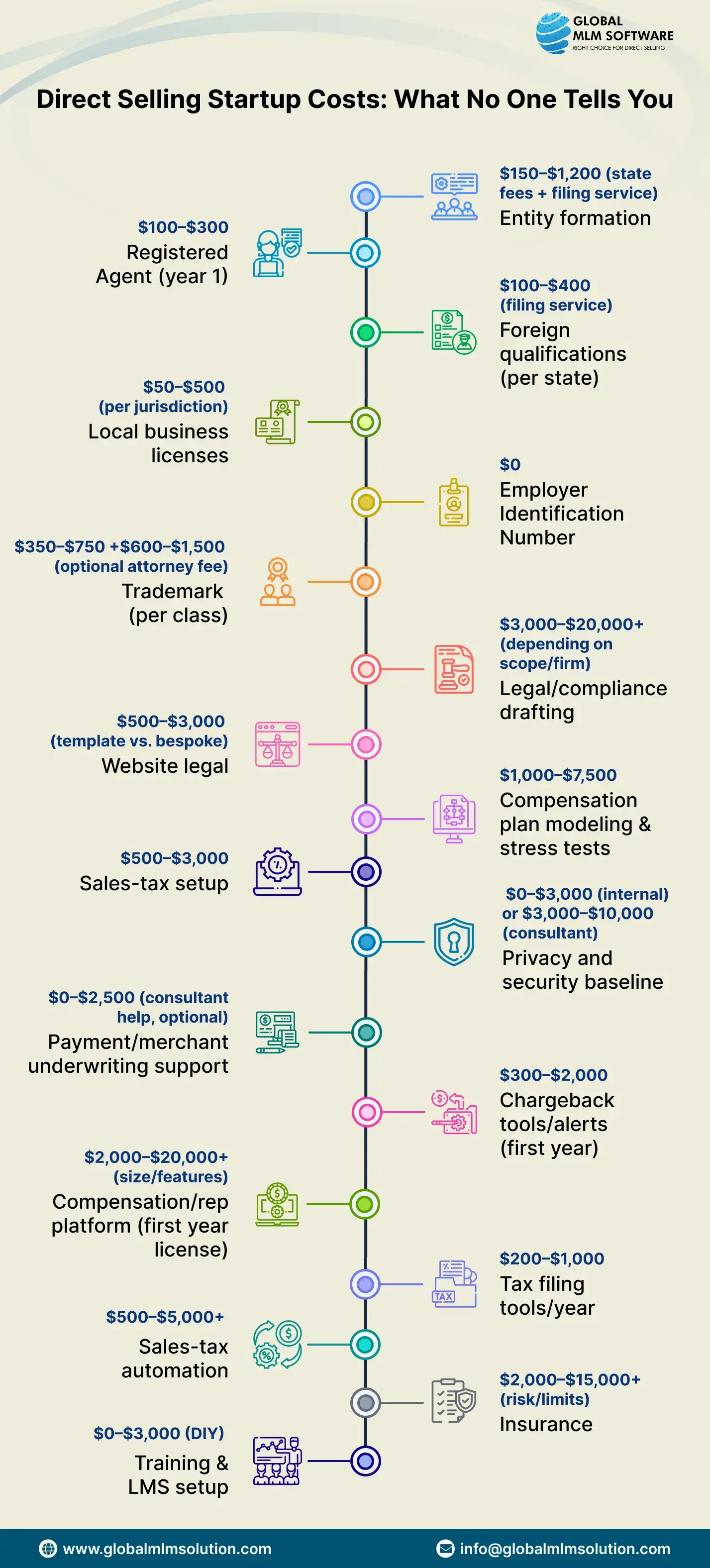

The foundation is your company's setup. Expect entity formation to run roughly $150–$1,200 (state fees plus any filing service). A registered agent for year one typically costs $100–$300. Your federal Employer Identification Number is free. If you operate beyond your formation state, add foreign qualifications at about $100–$400 per state, and plan for local business licenses at $50–$500 per city or county where you actually do business.

Brand protection and core legal come next. A U.S. trademark application usually costs $350–$750 per class in United States Patent and Trademark Office (USPTO) filing fees, and many founders also retain an attorney for $600–$1,500 to get it right. Drafting and hardening your compliance stack, policies and procedures, distributor agreement, income disclosure, returns/buyback, and claims guidelines can range from $3,000–$20,000+, depending on the scope and the firm. Don’t forget your website legal (privacy policy, terms, and disclosures), which often lands between $500–$3,000 depending on whether you use templates or bespoke work.

Your compensation engine and tax setup also carry real costs. Modeling and stress-testing a retail-first compensation plan typically runs $1,000–$7,500. Initial sales-tax setup from mapping product taxability to shipping rules often sits between $500–$3,000. Ongoing tools add smaller but recurring line items: general tax filing software at $200–$1,000 per year and sales-tax automation at $500–$5,000+, depending on volume and states.

Security, payments, and risk controls are core parts of launch readiness. A basic privacy and security setup that covers audits, vulnerability tests, and foundational controls typically ranges from $2,500 to $20,000, depending on scope and whether you use in-house resources or a consultant. Payment gateway and merchant underwriting support usually costs $300 to $2,500, based on the provider and documentation needs.

Chargeback-prevention tools and alert services start around $300 per year and can go up to $2,000 for higher-volume businesses. Putting these pieces in place makes processor onboarding smoother and helps prevent costly dispute issues later.

Technology and protection round out the picture. A compensation or representative platform license typically ranges from $2,000–$20,000+ for the first year, depending on size and features. Business insurance commonly falls between $2,000–$15,000+ based on risk and coverage limits. Training and LMS setup can be essentially free if you DIY ($0–$3,000), though many teams invest more as they scale.

Most of the above are one-time or first-year heavy lifts, with a few annual renewals and subscriptions. What ultimately moves your number up or down are the fundamentals: how many states you operate in, the risk profile of your products, the complexity of your compensation plan, your payment processor’s terms, and your security posture.

If you want a quick planning rule of thumb, budget for the low end if you’re piloting in a single state with simple products and a lean compensation plan. Budget toward the high end if you’re multi-state, regulated, or launching with advanced features from day one.