Insurance MLM Software

Scale Your MLM Insurance Operations with Global Insurance MLM Software

Automate policy sales, renewals, commissions, and reporting—all from one intuitive platform.

Automated Multi-Level Commission Distribution

Integrated Compliance & Regulatory Reporting

Instant Onboarding & Hierarchy Setup

Smart Alerts for Policy Expiry & Renewals

What is an Insurance MLM Software?

What is an Insurance MLM Software?

Insurance MLM Software is a specialized back-office solution that helps insurance companies and distributors manage their multi-level agent networks. It automates key operations like policy sales, premium collections, renewals, commission distribution, and compliance reporting, while giving agents a centralized dashboard to track their performance and clients.

Eg: An insurance company with hundreds of agents can use Insurance MLM Software to automate policy tracking, renewals, and multi-tier commissions. When an agent sells a health insurance policy, the system records the premium, calculates commissions for the agent and upline, and schedules renewal reminders—eliminating manual work and saving time.

Optimize Insurance Operations

Tools Built with Purpose for Streamlined Insurance MLM Management

Help your network focus on clients, while our system handles compliance and reporting.

- Monitor active, lapsed, and upcoming policies with real-time status updates.

- Automate renewal reminders to reduce policy lapses.

- Generate consolidated reports on premium collections across agents.

- Track claim-linked policies to maintain accurate records.

- Configure tiered commission rules aligned with insurance product categories.

- Automate payouts for agents and uplines based on real-time transactions.

- Maintain transparent payout histories to resolve disputes quickly.

- Streamline adjustments for refunds, cancellations, or revised policies.

- Capture and store KYC, licensing, and policy documents digitally.

- Automate compliance checks for region-specific insurance regulations.

- Generate regulatory-ready reports for audits and inspections.

- Restrict policy issuance for noncompliant agents or products.

- Onboard new insurance agents with structured workflows.

- Assign roles, hierarchies, and product access quickly and intuitively.

- Track individual and team sales performance with detailed metrics.

- Simplify network restructuring during mergers or regional expansion.

Simplify Policy Distribution with Our Insurance MLM Software

From customer onboarding to payouts—test it all with our insurance MLM software free trial and see the results firsthand.

Book A DemoStreamline Insurance Operations

Streamline Downline Success with Everyday Tools

From lead capture to policy issuance, help your team members work efficiently while keeping every step trackable and compliant.

Lead-to-Policy Workflows

Move prospects through a clear, auditable path from interest to issuance:

- Capture leads from web forms, referrals, and CSV imports, and tag each by source.

- Guided steps for product suitability, mandatory disclosures, and next actions.

- Auto-create a proposal populated with client and product data to reduce re-entry.

- View lead stage and next-step reminders so high-value prospects don’t fall through.

Our Features

Features of Global Insurance MLM Software

Beyond policy management and network growth, our insurance MLM software offers advanced tools to streamline backend operations, strengthen compliance, and improve overall efficiency.

Streamline Policy Management and Payouts Effortlessly

Simplify insurance operations and strengthen your distributor network with a platform built for scalable growth.

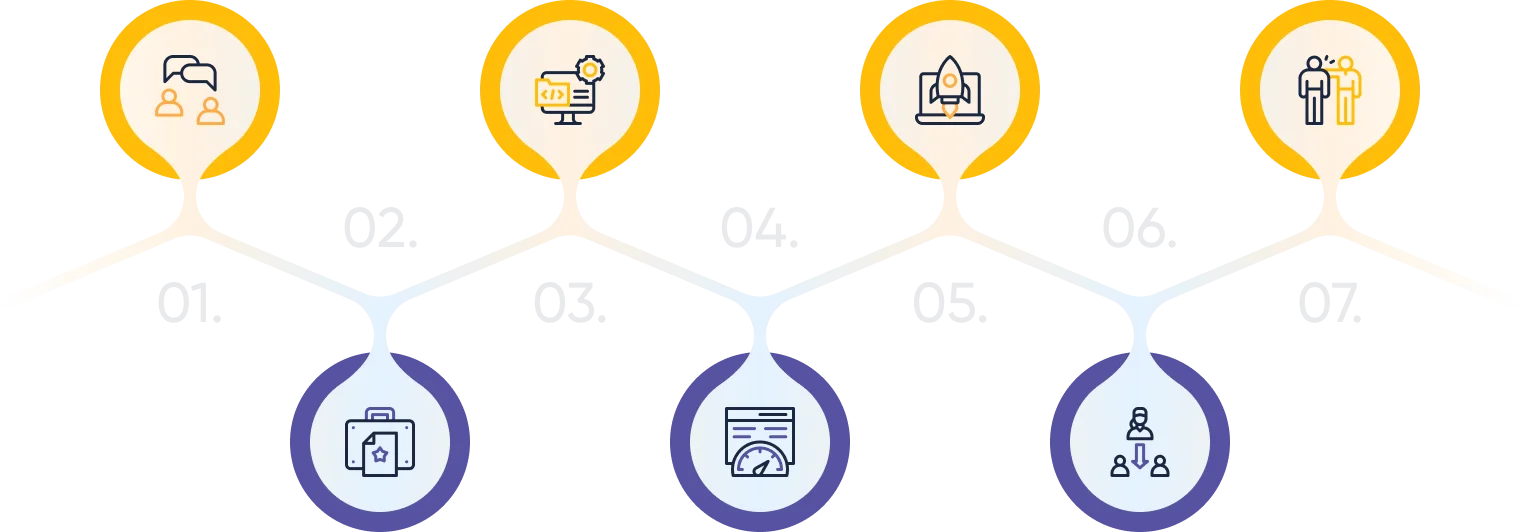

Try Free DemoHow to Get Started With Global Insurance MLM Software?

Ready to streamline your MLM insurance operations? Here’s the step-by-step process to get started:

Initial Consultation

Global MLM Software Setup and Configuration

Distributor and Customer Onboarding

Continuous Support and Training

Project Kick Off

End-to-End Testing

Business Go-Live

Initial Consultation

We begin by reviewing your insurance distribution model, policy offerings, and compliance requirements to design a solution aligned with your business goals.

Project Kick Off

After gathering the specifics—such as commission rules, policy types, and regional compliance—we set timelines and start configuring your insurance MLM platform.

Global MLM Software Setup and Configuration

Our team customizes the system to handle insurance workflows, including policy issuance, renewal tracking, premium collection, and agent hierarchy management.

End-to-End Testing

We simulate real insurance processes—policy creation, renewals, claims, and commission payouts—to ensure accuracy and reliability before launch.

Business Go-Live

Once validated, the insurance MLM software goes live, giving your team and agents immediate access to manage policies and payouts efficiently.

Distributor and Customer Onboarding

We assist agents and customers with portal access, showing them how to issue policies, track renewals, and manage client interactions seamlessly.

Continuous Support and Training

Post-launch, we provide ongoing training and support, covering compliance updates, software enhancements, and new insurance regulations.

Trusted by Leading Insurance MLM Networks

MLM Insurance businesses using Global MLM software have streamlined commissions, reduced manual policy handling, and improved distributor performance. Their results speak louder than promises, and their trust drives us forward.

How it Works?

How Does Global Insurance MLM Software Work?

Global MLM Insurance Software streamlines insurance network operations from lead capture to compliance reporting. Here’s a step-by-step look at how it works:

The system collects leads from multiple channels—including websites, referrals, and campaigns—and automatically segments them based on client profile, product interest, and region for targeted engagement.

Based on client data, policy history, and risk profiles, the software suggests suitable insurance products, helping agents provide personalized solutions while ensuring regulatory compliance.

Agents can instantly generate quotes and comprehensive proposal documents, including policy options, riders, and premium schedules, ready for client review without manual calculations.

Once a client accepts a policy, the platform guides the issuance process, linking all required forms, KYC documents, and approvals to create a complete, auditable policy record.

The software automatically calculates commissions across multiple levels of the insurance network, factoring in policy type, volume, and hierarchical rules, then logs them for transparency.

Built-in regulatory checks verify that each policy, premium payment, and client document meets local and industry requirements. Alerts notify users of missing or expiring documents to prevent compliance lapses.

The platform generates insights on agent performance, policy uptake, sales trends, and client retention, allowing managers to make informed strategic decisions and optimize network operations.

Benefits

Advantages of Global Insurance MLM Software

Global MLM Insurance Software equips your business with precise tools designed for managing policies, networks, and compliance efficiently, helping you strengthen both agent and client experiences.

- Built-in Anomaly Detection for Customer Fraud Prevention.

- Alerts and Notifications to Prevent Member Compliance Gaps.

- Mobile Access for Agents and Field Teams.

- Easy Integration with Accounting and CRM Systems.

- Seamless Multilingual Operations.

Global MLM Software is a leading MLM Software Development Company helping MLM Companies to manage and scale their MLM business.

Average Rating

Global Clients

Industries Served

Projects Completed

Countries Served

Years of Experience

Frequently Asked Questions

This FAQ has been compiled to answer some of the most frequently asked questions about our product and services. For more information, please Contact Us.

How is Insurance MLM Software different from regular insurance agency software?

Insurance MLM software is designed specifically for multi-level marketing networks in the insurance industry. Unlike standard insurance agency software, it supports multi-tier commission structures, tracks policy sales across a network of agents, manages downline operations, and provides analytics tailored for insurance network marketing.

How flexible is the commission structure with Insurance MLM Software?

Our insurance MLM software allows businesses to define multi-level commission plans, adjust payout percentages for different tiers, and manage bonuses or incentives for agents. This flexibility ensures that each insurance network can implement customized incentive structures to motivate agents and grow sales effectively.

How does the software handle compliance and regulatory requirements?

The Global MLM software for insurance companies tracks policy issuance, agent activities, and client documentation to ensure adherence to regional insurance regulations. Automated alerts notify administrators of missing documents or potential compliance gaps, reducing the risk of violations and helping maintain a fully compliant insurance network marketing operation.

Will the software integrate with existing systems like CRM, accounting tools, or lead sources?

Yes, the best insurance MLM software, like ours, offers integration capabilities with existing systems. It can seamlessly connect with CRMs, accounting tools, payment gateways, and lead sources, allowing insurance businesses to consolidate data, streamline operations, and maintain consistent workflows without the need for manual data transfers.

How is security and data privacy handled?

Our Insurance MLM software is built with industry-standard security measures. Data encryption, role-based access control, and secure storage ensure that sensitive client, policy, and agent information remains protected.

What is the onboarding and support like?

The onboarding process for our MLM software for insurance businesses is conveniently structured and straightforward. Teams provide step-by-step guidance to set up the system, configure policies, and train agents. Continuous support is available through chat, email, and dedicated account managers.

Does it support multi-language and multi-currency operations?

Yes, our insurance network marketing software supports multiple languages and currencies. This enables businesses to operate across different regions seamlessly, manage international agents, and provide localized experiences for clients without disrupting the core insurance MLM processes.

How much does Insurance MLM Software cost?

The cost of our insurance MLM software depends on the size of the network, the number of agents, and the specific modules required. We offer scalable pricing plans to match the needs of small to large insurance MLM businesses. For a precise quote, contact us directly to discuss business-specific requirements.

Does Global MLM Software provide a free trial or demo option for its insurance MLM software?

Yes, Global MLM Software offers a free trial and demo of our insurance MLM software. This lets businesses explore the system, test its features, and see how it works in practice before committing fully.

How long does it take to implement?

Implementation can be completed within 24 hours, including software setup, policy configuration, system integration, and agent onboarding.

Let's Get Started

User Guide

Essential Insights from Leaders in the MLM Insurance Industry

From client retention to agent engagement, explore actionable approaches that keep your network strong and compliant.

How Insurers Can Leverage the Power of Generative AI?

Unveiling the Potential of AI to Transform Insurance Operations and Distribution:

1. Enhanced Customer and Distributor Support

1. Enhanced Customer and Distributor Support

Generative AI can power advanced chatbots and virtual assistants that provide 24/7 support. These tools can answer complex queries from both policyholders and distributors about plans, commissions, or policy details, freeing up human agents to handle more strategic tasks and lead generation.

2. Personalized Marketing and Sales Content

2. Personalized Marketing and Sales Content

Move beyond generic brochures. AI can analyze distributor performance and customer data to generate personalized email drafts, social media posts, and presentation content tailored to specific demographics, significantly boosting engagement and conversion rates for your network.

3. Streamlined Documentation and Process Automation

3. Streamlined Documentation and Process Automation

AI can automate the summarization of lengthy claim documents, policy wordings, and compliance manuals. It can also draft routine communications and reports, drastically reducing the administrative overhead for both the corporate team and the field force.

How Global MLM Helps:

- Provides structured policy management modules to apply AI insights directly to your MLM workflow.

- Offers configurable commission logic to reward agents for upselling personalized policy bundles.

- Ensures AI-driven decisions are backed by clear audit trails for compliance purposes.

- Helps insurers integrate external AI tools smoothly within their MLM operations.

What is Embedded Insurance and Why Are E-commerce Platforms Adopting It?

Seamlessly Integrating Protection into the Customer's Journey for New Revenue Streams:

1. Frictionless Customer Experience

1. Frictionless Customer Experience

Embedded insurance allows a customer to purchase a relevant policy at the exact point of need. For example, buying phone protection at checkout on an electronics site. This eliminates a separate, complex buying process, leading to higher adoption rates and increased customer satisfaction.

2. Access to New, Targeted Markets

2. Access to New, Targeted Markets

By partnering with e-commerce platforms, insurers can reach a vast pool of pre-qualified customers who are already engaged in a purchase. This provides direct access to specific demographics (e.g., travelers, gadget owners, pet lovers) with highly relevant offers.

3. Data-Driven Product Development

3. Data-Driven Product Development

These partnerships provide invaluable data on consumer behavior and purchase patterns. Insurers can leverage this data to design innovative, hyper-specific micro-insurance products that perfectly match the evolving needs and risks of modern consumers.

How Global MLM Helps:

- Manages complex commission structures for embedded insurance partnerships.

- Tracks policy sales and performance metrics for each partner channel.

- Supports distributor networks focused on building B2B partnerships.

- Scales to handle high volumes of micro-policies efficiently.

What is On-Demand Insurance and Why is it Popular with Millennials and Gen Z?

Meeting the Demand for Flexible, Bite-Sized, and Digital-First Coverage:

1. Ultimate Flexibility and Control

1. Ultimate Flexibility and Control

On-demand insurance allows users to activate, pause, or modify coverage in real-time based on their immediate needs. This pay-as-you-go model is perfect for gig economy workers, short-term rentals, or borrowing high-value items, giving these generations control over their spending.

2. Digital-Native Accessibility

2. Digital-Native Accessibility

Our insurance direct selling software is built for smartphone use too. Purchasing and managing a policy is done through intuitive apps and websites, aligning perfectly with the preferences of millennials and Gen Z, who expect instant, digital solutions for all aspects of their lives.

3. Affordability and Transparency

3. Affordability and Transparency

Customers only pay for the coverage they need, when they need it. This makes insurance more affordable and understandable, removing the barrier of large annual premiums and complex policy terms that traditionally deter younger audiences.

How Global MLM Helps:

- Accurately calculates prorated and fractional commissions for flexible plans.

- Tracks short-term policy activation and deactivation dates seamlessly.

- Provides tools for distributors to manage and explain flexible products.

- Delivers clear performance analytics for high-volume, low-premium products.

What are the challenges faced by the insurance industry in 2025, and how can global MLM software provide solutions?

Navigating a Complex Landscape with Robust and Adaptive Technology:

1. Digital Transformation and Legacy Systems

1. Digital Transformation and Legacy Systems

Many insurers struggle with outdated, siloed systems that cannot integrate with modern digital tools. This creates inefficiencies, data errors, and a poor experience for both customers and distributors, hindering growth and agility in a fast-paced market.

2. Evolving Distribution Channel Management

2. Evolving Distribution Channel Management

Managing hybrid networks of traditional agents, digital partners, and MLM distributors is complex. Manually tracking performance, calculating hybrid commissions, and ensuring compliance across these diverse channels is a significant operational challenge.

3. Data Security and Regulatory Compliance

3. Data Security and Regulatory Compliance

With increasing cyber threats and constantly evolving regulations (like data privacy laws), insurers must ensure the highest level of security for sensitive customer data and guarantee that all operations are fully compliant, which is difficult with manual processes.

How Global MLM Software Provides Solutions:

- Replaces legacy systems with a unified, cloud-based platform.

- Automates complex commission calculations for any network structure.

- Enhances data security and simplifies compliance with role-based access.

- Provides real-time analytics for strategic, data-driven decision making.