MLM Platform for Finance Industry

Next-Gen MLM Platform for Finance Industry Built for Convenience & Growth

Manage multi-tiered commissions, product-led payouts and audit-ready ledgers for investment and annuity offerings — we handle the complexity, you handle growth.

Portfolio &

ROI Reports

Automated Retention Alerts

Instant Transaction Notifications

Audit-Ready

Ledgers

What is an MLM Platform for Finance Industry?

What is an MLM Platform for Finance Industry?

An MLM platform for Finance Industry is a specialized back-office software that helps financial MLM service providers manage their distributor networks, automate commission payouts, track member investments, and ensure compliance with financial regulations. It is built to handle products such as annuities, mutual funds, savings plans, forex, or crypto offerings—making it easier for companies to run and scale multi-level financial businesses.

For example, imagine a company distributing mutual fund investment plans through a multi-level network. Each distributor introduces investors to different SIPs or lump-sum plans, earns commissions on new investments, and also benefits when their downline brings in clients. Instead of manually calculating contributions, commissions, and portfolio growth, the MLM platform automates the process—tracking investments in real-time, ensuring accurate commission payouts

Smarter Oversight for Growing Finance MLM Businesses

Get Centralized Control for Managing Finance Operations with our MLM Software for Finance Business

From onboarding to commission settlements, manage every administrative task with accuracy and clarity.

- Define multi-level commission structures for different financial products.

- Automate recurring payouts with accurate percentage calculations.

- Configure tier-based bonuses for members across levels.

- Monitor pending, completed, and disputed payments in real time.

- View investment inflows across multiple tiers.

- Track fund allocation, maturity timelines, and returns.

- Generate product-wise performance reports instantly.

- Flag unusual investment activity for administrative review.

- Automate verification of distributor and client documents.

- Set reminders for KYC/AML renewal deadlines.

- Restrict payouts for members with incomplete compliance.

- Maintain a centralized log for audits and regulators.

- Configure payout frequencies and maturity timelines.

- Track annuity purchases linked to member investments.

- Monitor active and matured annuity contracts in real time.

- Control eligibility based on investment thresholds or age criteria.

Move Beyond Manual Oversight with a Financial Services-Ready MLM Platform

We help businesses transition from scattered processes to one unified MLM Platform for Finance Industry—built to handle transactions, growth, and regulation.

Talk to Our ExpertsElite Member Experience Built for the MLM Platform for Finance Industry

Self-serve workflows for onboarding, payouts, and product enrollment.

Reduce back-and-forth by letting users upload documents, request withdrawals, and monitor enrollment status in real time.

Personal Profile & Verification Progress

See and complete every verification step required to transact and earn:

- Upload identity and address documents with OCR-assisted validation and status flags.

- View outstanding verification items and next required actions (e.g., mandate, proof of income).

- Download time-stamped verification receipts for regulator or partner review.

- Link verification status to available actions (e.g., withdrawals locked until verification clears).

Our Features

Features of Finance MLM Software

Our integrated finance MLM software is designed to bring together compliance, analytics, CRM, and integration under one roof. We ensure that your network runs smoothly, while meeting financial regulations and delivering measurable results.

Take the Next Step in Growing Your MLM Finance Business

Global MLM equips your network with automation and transparency to help streamline every part of your business. Experience the best finance mlm software today.

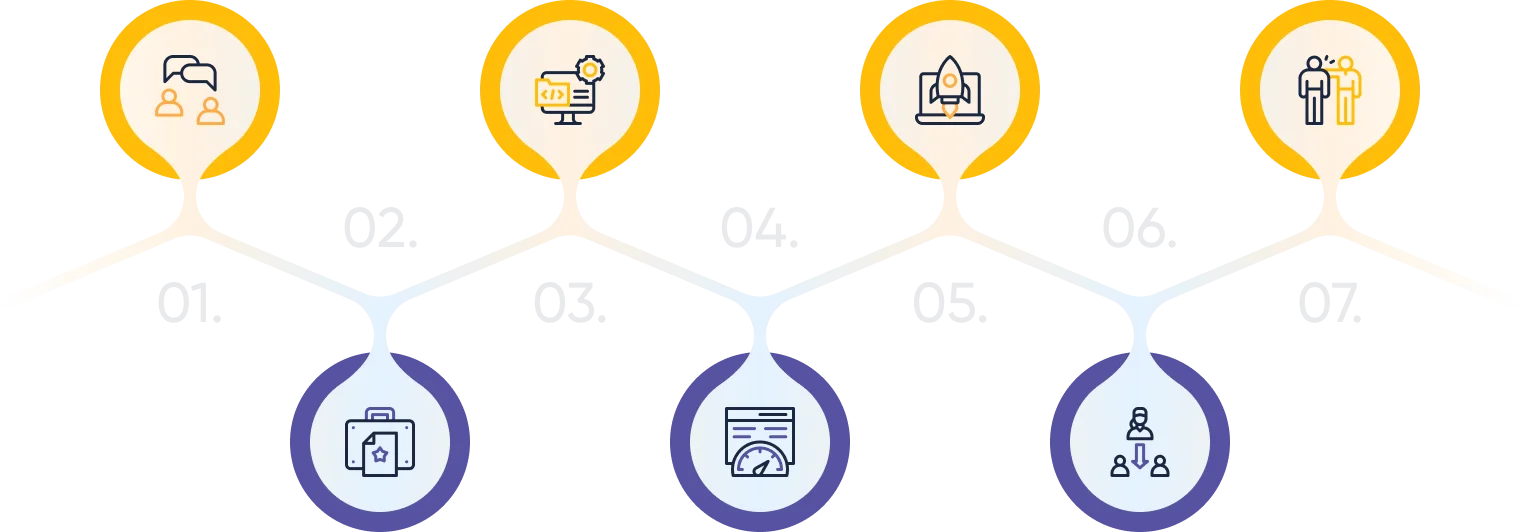

Get Started NowHow to Get Started With Global MLM Platform for Finance Industry

Setting up our financial MLM platform is straightforward. Here’s how we help you go live seamlessly.

Initial Consultation

Global MLM Software Setup and Configuration

Distributor and Customer Onboarding

Continuous Support and Training

Project Kick Off

End-to-End Testing

Business Go-Live

Initial Consultation

We assess your financial business model—whether it’s annuities, investment plans, or insurance—and define how the MLM structure will integrate with your offerings.

Project Kick Off

After gathering insights, we create a roadmap aligned with your compliance needs, distributor hierarchy, and financial product portfolio to ensure clarity from day one.

Global MLM Software Setup and Configuration

Our team configures the platform to handle finance-specific processes such as annuity disbursements, investment tracking, commission distribution, and secure transaction workflows.

End-to-End Testing

We simulate financial transactions, repayment cycles, interest calculations, and distributor payouts to confirm accuracy, transparency, and regulatory compliance.

Business Go-Live

Once validated, we launch your fully configured finance MLM platform—ready to manage distributor operations, customer onboarding, and financial product delivery.

Distributor and Customer Onboarding

We assist in seamlessly onboarding both distributors and end-customers, training them on using the system for investment plans, annuity applications, or commission tracking.

Continuous Support and Training

Our support doesn’t end after launch. We provide ongoing compliance updates, security monitoring, feature enhancements, and tailored training to keep your finance MLM operations running smoothly.

Trusted by MLM Industry Leaders to Power Their Financial Growth

At Global MLM, our clients trust us because we align our superior technology of MLM software for finance businesses with their financial goals, ensuring transparency, compliance, and sustainable network growth. Here is what our clients had to say:

How it Works?

How Does the Global MLM Platform for Finance Industry Work?

From fund management to compliance reporting, see how our MLM platform for finance industry powers secure, transparent, and scalable operations:

Each financial product—annuity, insurance or investment schemes—is registered in the system with lifecycle stages. Compliance checks, mandatory disclosures, compensation mapping, and jurisdictional approvals are enforced automatically before products go live.

Banks, custodians, payment gateways, and service partners are integrated through a structured workflow. Escrow and custodial accounts are mapped to financial products to guarantee secure fund collection, settlements, and payouts.

Client funds are collected in controlled ledgers or escrow accounts and released only after passing KYC, underwriting, or mandate verification.

The platform continuously calculates creditworthiness and risk for each network member based on repayment history, transaction behavior, referral quality, and external bureau data. These scores automatically adjust eligibility, term limits, and pricing.

Forecasting engines project upcoming disbursements and payout obligations to determine reserve requirements. Funds are allocated across internal pools with priority settlement rules, currency routing, and hedging options to maintain liquidity.

Regulatory reports—including transaction registers, withholding summaries, and jurisdiction-specific filings—are automatically generated. Supporting documents and audit trails are packaged and stored securely.

Real-time reconciliation checks compare gateway settlements, bank statements, and internal ledgers. Discrepancies trigger automated alerts with actionable steps, while platform monitoring tracks SLAs, backups, and security.

Benefits

Advantages of Global MLM Platform for Finance Industry

Simplify complex finance MLM processes and improve operational efficiency for your network and members.

- Automated Fund Release Based on Eligibility Checks.

- Secure, Traceable Ledger and Transaction Records.

- Configurable Compensation Plans for Financial Products.

- Flexible Product Lifecycle and Activation Controls.

- Streamlined Customer Onboarding.

Global MLM Software is a leading MLM Software Development Company helping MLM Companies to manage and scale their MLM business.

Average Rating

Global Clients

Industries Served

Projects Completed

Countries Served

Years of Experience

Frequently Asked Questions

This FAQ has been compiled to answer some of the most frequently asked questions about our product and services. For more information, please Contact Us.

How does Finance MLM Software help financial businesses grow?

Our financial services MLM platform automates core operations like commission tracking and payout processing, eliminating manual errors and freeing up leadership to focus on sales and recruitment strategy. By providing distributors with transparent, real-time performance tools, it boosts productivity and motivates the entire sales network.

Is Finance MLM Software different from regular MLM software?

Yes. While regular MLM software caters to general industries, the MLM platform for finance industry is tailored for financial services. It includes dedicated modules for insurance, forex, and investment businesses, with compliance checks, multi-currency MLM software for finance, and specialized reporting.

Does the software support different MLM compensation plans?

Yes, our MLM platform for finance industry is highly flexible. It is designed to accurately calculate and automate payouts for a wide array of plans—from binary and matrix to unilevel and hybrid models.

Does the software allow integration with banking APIs, payment gateways, or e-wallets?

Seamless integration is a cornerstone of our MLM platform for finance industry. The software is designed to connect securely with major banking APIs, international payment gateways, and e-wallet systems. This facilitates smooth, automated, and secure deposits and withdrawals, making our solution a true finance MLM platform with e-wallet capabilities.

How does Finance MLM Software ensure compliance with financial regulations?

Compliance is non-negotiable. Our MLM software for finance business incorporates built-in features to enforce regulatory standards. This includes automated KYC & compliance document collection and verification, audit trails for all transactions, and configurable rules to adhere to regional financial regulations.

Is the software secure enough for sensitive financial and customer data?

Security is our top priority. We employ bank-grade encryption, secure socket layer (SSL) certificates, and rigorous access controls to protect all sensitive data. Our secure MLM payment gateway integrations and adherence to international data protection protocols ensure that your financial and customer information remains completely safeguarded.

Can distributors and agents track their commissions and downline performance easily?

Yes. A key benefit of our finance network marketing software is its transparent, user-friendly dashboard. Distributors can log in at any time to view their detailed commission statements, track downline performance metrics, analyze team growth, and monitor their earnings in real-time.

Is the software scalable for both startups and large financial organizations?

Our MLM platform for finance industry is built on a scalable cloud architecture. Whether you are a startup building your network or a large enterprise with a vast, global distributor base, the platform effortlessly scales to handle increasing transaction volumes, user numbers, and data loads without compromising on speed or performance.

Can the software be customized for insurance, forex, or investment MLM businesses?

Yes, our MLM platform for Finance Industry is highly adaptable. Our direct selling software for finance can be tailored to the specific operational and regulatory needs of various niches, including insurance MLM, forex affiliate programs, and investment-based multi-level marketing models, providing a perfect fit for your business.

Does Finance MLM Software provide real-time reports and financial analytics?

Definitely. Powerful MLM reporting and analytics are at the core of our platform. Leadership gains access to a comprehensive suite of real-time reports on sales, revenue, distributor performance, and network growth. These actionable insights are crucial for making informed, data-driven strategic decisions to guide your business forward.

Let's Get Started

User Guide

Take Control of Your Financial MLM Network Like a Pro: Practical Tips

Learn key strategies and best practices to optimize operations, manage risk, and empower your financial network effectively.

How Artificial Intelligence is Transforming the Financial Services Industry

Exploring smarter decision-making and efficiency in modern finance:

1. Risk Assessment and Fraud Detection

1. Risk Assessment and Fraud Detection

AI has enabled financial institutions to detect anomalies in transaction patterns, identify fraudulent activities, and predict potential risks. This allows businesses to act faster, protect assets, and maintain customer trust in a highly dynamic environment.

2. Personalized Financial Services

2. Personalized Financial Services

From investment advice to credit scoring, AI is reshaping how customers experience finance. Intelligent algorithms evaluate user behavior and create tailored solutions, ensuring that financial offerings meet specific needs with precision.

3. Process Automation for Cost Savings

3. Process Automation for Cost Savings

Repetitive tasks like data entry, claims validation, and compliance reporting are increasingly automated. This boosts productivity, reduces operational costs, and allows businesses to focus more on customer acquisition and strategic growth.

How Global MLM Helps:

- Provides reliable automation tools that reduce manual financial operations.

- Supports compliance-friendly workflows for safer financial transactions.

- Enables transparent reporting to maintain stakeholder trust.

- Offers scalable solutions to handle growing transaction volumes.

Machine Learning in the Financial Industry: A Bibliometric Approach to Evidencing Applications

Understanding how machine learning enhances insights in finance:

1. Data-Driven Investment Strategies

1. Data-Driven Investment Strategies

Machine learning models analyze huge volumes of historical and real-time market data, identifying trends and predicting investment opportunities with higher accuracy than traditional methods.

2. Customer Behavior Analysis

2. Customer Behavior Analysis

Banks and financial service providers use ML to segment clients, predict churn, and enhance customer lifetime value. This strengthens customer loyalty and sharpens marketing campaigns.

3. Predictive Risk Modelling

3. Predictive Risk Modelling

ML algorithms evaluate credit histories, repayment patterns, and market variables to forecast loan defaults and other financial risks. This allows financial companies to make safer and more profitable decisions.

How Global MLM Helps:

- Delivers advanced reporting modules to analyze distributor and customer data.

- Assists businesses in designing commission structures backed by analytics.

- Provides integrations that simplify complex data management.

- Offers dashboards that make financial insights easy to interpret and act upon.

How Cloud Computing is a Game Changer for Financial Services

Enabling Scalability, agility, and Cost-Efficiency in a Digital-First Landscape:

1. Unmatched Scalability and Flexibility

1. Unmatched Scalability and Flexibility

Cloud infrastructure allows financial institutions to seamlessly scale their IT resources up or down based on real-time demand. This eliminates the need for costly physical hardware investments and ensures the platform can handle peak loads, such as during new product launches or market volatility, without performance issues.

2. Enhanced Collaboration and Remote Accessibility

2. Enhanced Collaboration and Remote Accessibility

Cloud-based platforms enable secure access to data and applications from anywhere in the world. This fosters collaboration among geographically dispersed teams, agents, and distributors, ensuring everyone has the real-time information they need to perform effectively, which is crucial for a distributed sales network.

3. Improved Disaster Recovery and Business Continuity

3. Improved Disaster Recovery and Business Continuity

Cloud service providers offer sophisticated, automated backup and recovery solutions. This ensures that critical financial data and applications are protected against local system failures, natural disasters, or cyber attacks, guaranteeing minimal downtime and maintaining trust.

How Global MLM Helps:

- Offers a cloud-based platform that scales with your network growth.

- Enables secure remote access for administrators and distributors.

- Ensures high availability and robust data backup.

- Reduces IT overhead by eliminating on-premise servers.

Core Challenges in the Financial Services Industry and How Global MLM Software Can Help

Bridging gaps in compliance, scalability, and distributor management

1. Regulatory Pressure

1. Regulatory Pressure

Financial businesses face stringent compliance requirements that slow down operations. Navigating these without the right tools can lead to delays and penalties.

2. Scalability Issues

2. Scalability Issues

As networks expand, traditional systems struggle to keep pace with large transaction volumes, multi-currency support, and global operations.

3. Distributor Engagement Gaps

3. Distributor Engagement Gaps

Motivating and retaining distributors remains a challenge when businesses lack real-time tracking, transparent commissions, and engaging dashboards.

How Global MLM Helps:

- Integrates compliance-ready modules like KYC and audit trails.

- Offers multi-currency and multi-branch support for global scalability.

- Ensures transparent commission distribution through automated payouts.

- Delivers performance insights that help retain and motivate distributors.