The Global Insurance industry, worth over $3.93 trillion isn’t just for big insurance firms anymore. MLM companies are strategically establishing their presence in this rapidly expanding sector.

Ever since the concept of insurance was introduced, it has served as a vital financial tool for families. It was traditionally offered through corporate agents and brokers, but now MLM Insurance companies are taking that concept and giving it a twist by combining it with network marketing.

In this article, we have come up with a list of MLM insurance companies that are raising the bar by offering top-tier insurance products with unmatched customer experiences.

This Article Contains:

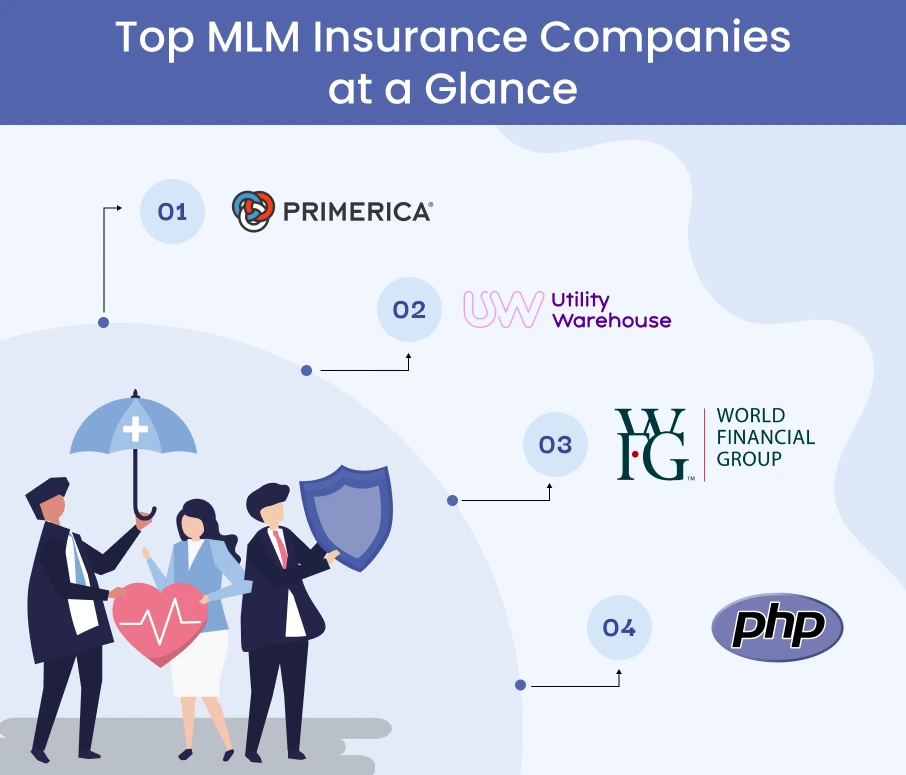

Top MLM Insurance Companies at a Glance

| Sl No | Company Name | Founder | CEO | Year Founded | Revenue |

|---|---|---|---|---|---|

| 1 | Utility Warehouse | Charles Francis Wigoder | Stuart Burnett | 1996 | $2.5 Billion |

| 2 | World Financial Group | Steeley Hubert Humphrey | Todd Buchanan | 2001 | $1.5 Billion |

| 3 | PHP | Patrick Bet-David | Patrick Bet-David | 2009 | $440 Million |

A Curated List of MLM Life Insurance Companies

We’ve reviewed each brand’s offerings, agents' training, compensation structure, customer satisfaction, and overall market presence. The MLM insurance companies mentioned in this list passed all of the above criteria, along with being credible, compliant, and demonstrating consistent performance over the years.

1. Utility Warehouse

Utility Warehouse is a trusted name among the MLM companies in the UK, known for providing a range of essential services under a single umbrella, like electricity, gas, landline and mobile connections, high-speed internet connections, and insurance.

While UW is known for its utility services, it is also a life insurance MLM. The company offers insurance products for home, boiler, electronics, plumbing, and other gadget insurance.

The comprehensive coverage that UW offers has made it a household name in the UK. Today, the company has around 70,000+ UW partners who earn commissions by referring new customers and building teams.

One of the main reasons the company has managed to build a large team of partners is its “Free Energy Club” initiative. Under this scheme, UW partners can reduce their utility bills to zero by signing up a few customers in a month. This initiative has worked as a great strategy to increase partner sign-ups.

Also, the company provides an upfront commission of $380 for every customer they introduce to the company. They also receive a percentage of their customers’ bills, for as long as they stay with UW. This prospect of residual income makes it a great earning opportunity.

Utility Warehouses shows us that combining strong upfront incentives with a bundled service-based product is a sure-shot way to succeed in the insurance MLM industry.

2. World Financial Group

World Financial Group (WFG) is a US-based finance and insurance MLM company founded in 2001. It is a part of the much larger Transamerica group of companies. WFG primarily operates in the US and Canada, and mainly deals with insurance, among other financial services.

WFG partners with reputable providers like Transamerica, Pacific Life, and Prudential to offer Term and Permanent Life Insurance. This means that the brand works as a third-party MLM insurance provider.

This business model has been gaining prominence for a while now. It allows WFG to distribute insurance products from multiple established providers, rather than underwriting policies themselves.

But how does this benefit everyone?

For the company:

When WFG acts as a third-party distributor, it is able to completely bypass the heavy financial and regulatory burdens of underwriting and claims management and focus on its core operations. This model also allows the company to offer a diverse range of high-quality insurance products that can appeal to various customer groups.

For the Customers:

Customers receive personalized services from licensed agents who offer tailored solutions from reputable providers. They get access to reliable, high-quality products without conforming to the one-size-fits-all approach. This results in higher customer satisfaction.

For the Agents:

WFG agents get access to multiple top-tier insurance carriers. This allows them to offer customized solutions to clients. They also get to build credibility by representing trusted brands, which the customers may already be aware of. Also, agents can sell a wide portfolio of products, which naturally increases their earnings potential.

Currently, WFG has a team of 85,000 licensed professionals who have built a thriving business selling its products. Also, the company has paid over $1.4 billion in commission for 2024.

This is only because of the company’s high-potential business plan that allows these agents to earn in multiple ways.

If you’re just starting out or planning to scale your Life insurance MLM company, acting as a third-party provider is a smart, low-risk option. You can access reputable products and instead focus your efforts on training your reps, building teams, and creating a strong customer base.

3. PHP

PHP, short for People Helping People, is one of the most well-known MLM insurance companies in the US. It is headquartered in Addison, Texas, and operates in over 49 US states and Puerto Rico.

Its range of insurance products includes life insurance and annuity products, including term-life, return of premium term life, indexed universal life (IUL), no-medical exam policies, and fixed indexed annuities. It's a third-party provider that partners with carriers like National Life Group, America National, Allianz, Foresters Financial, and more.

While it is listed among the typical MLM insurance companies, PHP’s brand positioning is what makes it different from the rest.

PHP positions itself as a technology-enabled, diversity-focused financial service provider, with its network comprising over 43% Hispanic and 34% black members. The brand also shifts its focus to the underserved communities in America, who may not have access to quality financial education or services.

Through this motto, PHP has managed to serve over 600,000 families with its 50,000+ network of licensed agents.

But it's not just creating waves with its inclusive agent community, PHP also offers one of the most rewarding compensation plans with a potential of earning up to 152% in gross payouts.

PHP’s 11-level unilevel MLM Plan provides a progressive increase in the percentage of direct commissions as the agents move up in ranks. While trainees start with 30%, agents at the Chairman’s Council, the highest rank, can earn anywhere between 82% and 152% in commissions.

This is possible because PHP combines base commissions with additional bonuses and generational overrides, which are layered across personal and team performance

On top of that, agents can earn up to 40% direct commission bonuses, which again increase at higher levels.

So, how can you adopt PHP’s strategy for your MLM Insurance company? Focus on serving the underserved communities and empower your agents with the right tech stack. This dual approach of empowerment and inclusion can highly strengthen your distributor network and brand credibility.

Conclusion

Today’s Insurance MLMs have a strong emphasis on professionalism, where licensed professionals are trained and equipped with the latest tech tools. In an era where customers are more discerning, it is important to build trust through transparency and personalized solutions rather than relying solely on sales tactics.

So, the bottom line is that you must focus on creating real value for both your customers and your agents if you are looking to build a sustainable MLM Insurance company that will stand the test of time.

FAQs

1. What is an MLM insurance company?

MLM insurance companies use a multi-level marketing model to sell insurance products like term life, health, or home insurance. Licensed agents earn commissions not just on their own sales but also on the sales made by the agents they recruit.

2. What makes MLM insurance companies different from traditional insurance companies?

Top MLM insurance companies differ from their traditional counterparts solely in their distribution model. While insurance MLMs rely on independent agents to build their networks and earn commissions, it is not a strict requirement for agents in traditional insurance companies to build teams. The focus is only on earning from personal sales.

3. How do the compensation plans of MLM insurance companies typically work?

MLM insurance companies usually pay commissions on each policy sold. They also earn a percentage of sales made by their team members. Many insurance MLMs also offer bonuses for rank advancement and long-term residual income.

4. Are there compliance or legal issues unique to MLM life insurance companies?

Yes, you need to comply with state-level licensing regulations, disclosure norms, and financial conduct standards. Life Insurance MLM businesses normally operate in a tightly regulated environment, so it is important to stay within the law.

References

-

Businessforhome.org

Disclaimer: Global MLM Software do not endorse any companies or products mentioned in this article. The content is derived from publicly available resources and does not favor any specific organizations, individuals or products.